- District

- Families

- Athletics

- Bus Stops

- Emergency Closure/Delayed Start Policy

- Guardian Technology Tips

- Literacy Resources

- Nondiscrimination

- Online Meal Payments

- Safety and Security

- Skyward

- Skyward & School Messenger Tutorials

- Student Login Portal

- Student Passwords

- Student Services

- Student Testing

- Title IX

- Utah Parent Center

- Volunteer

- Schools

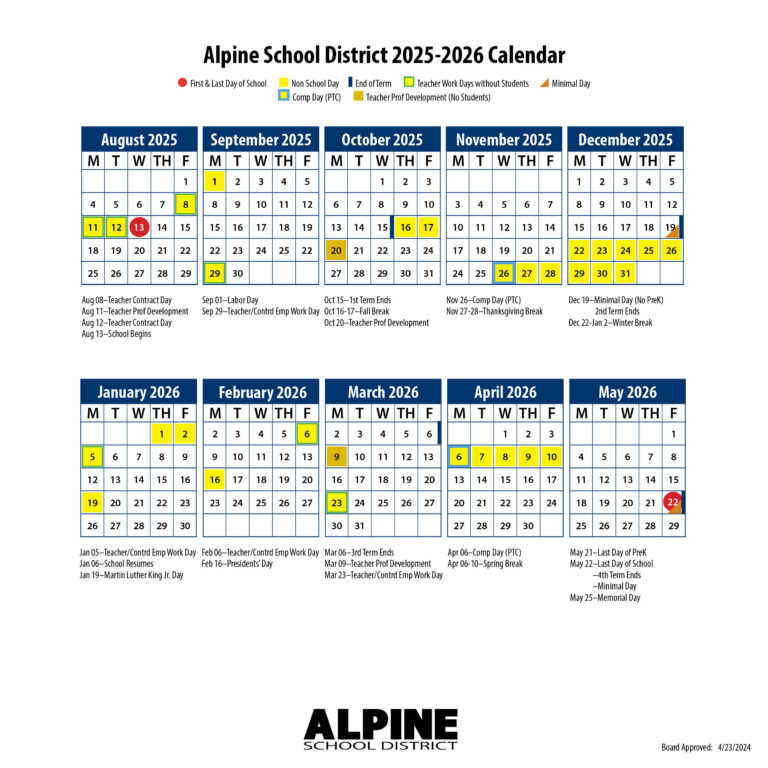

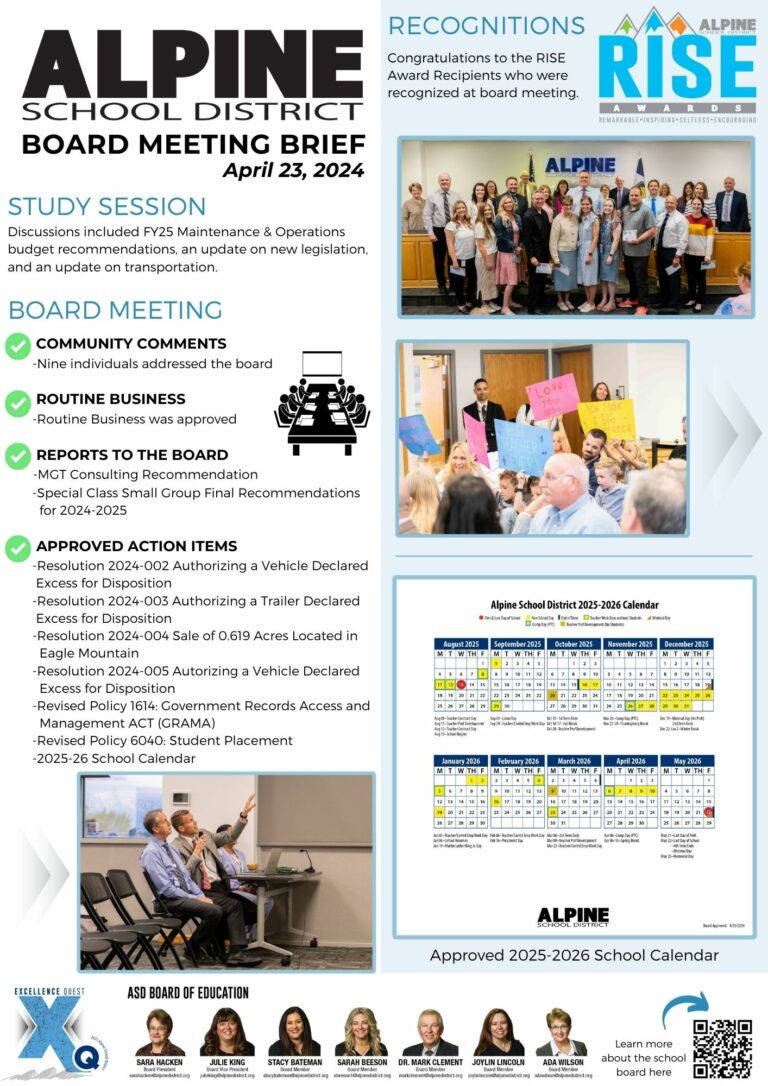

- School Board

- Employees